A resident asked me (a while ago) to investigate what happens to the revenue collected by the Township’s construction office.

Scope and Source

We honed in on 2024 as a sample and requested the following through OPRA:

All records of revenue collected by the Construction Department from January 1, 2024 to 12/31/2024. Including (but not limited to):

Permit fees (building, electrical, plumbing, etc.)

Plan review fees

Inspection fees

Penalties or fines

Any other revenue or fees collected

All records indicating where these revenues are allocated or transferred, including:

Budget line-item allocations or transfers into the general fund

Any dedicated accounts or trust funds used

Supporting ledger entries or internal memos that show how the funds were categorized or disbursed

This article is based on:

- Records recieved from this request.

- The 2024 Annual Financial Statement

- Email Exchanges with the Township CFO

Findings

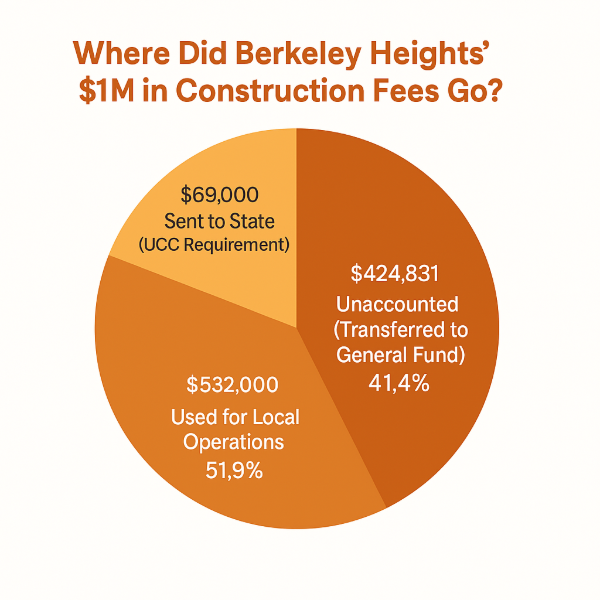

Berkeley Heights collected over $1 million in construction-related fees — but nearly half of that revenue went unaccounted for in any public records.

According to documents cited above, the Township’s Construction Department brought in a total of $1,025,831 in 2024. Of that, about $532,000 was used to cover local expenses, including salaries, benefits, and department operations. ~ $69,000 was sent to the State of New Jersey as required under the Uniform Construction Code (UCC).

That leaves roughly $424,000 with no documentation showing where it went.

The Township CFO confirmed that the unspent funds were simply closed into the Township’s general fund at the end of the year. No separate records exist showing how that money was allocated, used, or retained.

This issue isn’t unique to construction revenue. Earlier this year, NJ21st examined fire inspection revenue and found similar transparency concerns with no public records explaining how those funds are being used to support code enforcement.

Analysis

While this practice is legal under New Jersey law, it also raises a question of transparency. Once the money enters the general fund, there is no way to track what it’s used for. Residents and builders who pay these fees have no clear insight into whether that revenue is being reinvested in building safety, staffing, or service improvements.

This isn’t how every town handles construction fee revenue.

In Warren Township, Hammonton, Morristown, Belleville, and Medford, excess construction code fees are kept in a separate account known as a “trust by rider.” This kind of account allows towns to carry over unspent funds from year to year. It restricts their use to supporting the construction office, such as hiring inspectors, upgrading software, or improving turnaround times on permits.

This practice is encouraged by the State of New Jersey. The Department of Community Affairs (DCA) has published guidance supporting the use of rider accounts for UCC fees as a best practice for municipalities seeking long-term planning and financial transparency.

Berkeley Heights currently does not use a trust account for construction revenue. Instead, any money left over at year’s end is pooled into the same fund that covers general operating expenses, meaning it could ultimately be spent on anything from paving roads to office supplies.

This limits the public’s ability to see how fee revenue is actually used or to hold the Township accountable for improving services tied to that revenue stream.

Solution

Establish a dedicated fund..

WHEREAS, the Township of Berkeley Heights collects revenue through the enforcement of the Uniform Construction Code, including fees for permits, inspections, and plan reviews; and

WHEREAS, New Jersey law allows municipalities to set aside such revenue in a dedicated “trust by rider” account, ensuring that the money is used to support code enforcement and departmental needs; and

WHEREAS, other towns across the state have already established such accounts with the approval of the Division of Local Government Services;

NOW, THEREFORE, BE IT RESOLVED, that the Township Council authorizes the creation of a Uniform Construction Code Trust Fund, and directs the Finance Department to submit the appropriate forms to the state for approval;

BE IT FURTHER RESOLVED, that all future UCC revenue collected beyond the amount needed for that year’s operating expenses shall be placed in this dedicated account, to be used solely for purposes that support the construction office, including staffing, training, inspections, and related improvements.

Five simple lines to improved transparency.

Read More About the Berkeley Heights Town Council

Subscribe to NJ21st For Free

Our Commitment to Ethical Journalism

|