Morris County is heading down the same tunnel as Union, Middlesex, and Somerset: budgets are up, outside revenues are down, and taxpayers are looking in between couch cushions to cover the difference. Whether you want to tag it as a “modest increase,” or a “flat rate,” for the PR folks, the end result is the same… flat rates yet a higher bill.

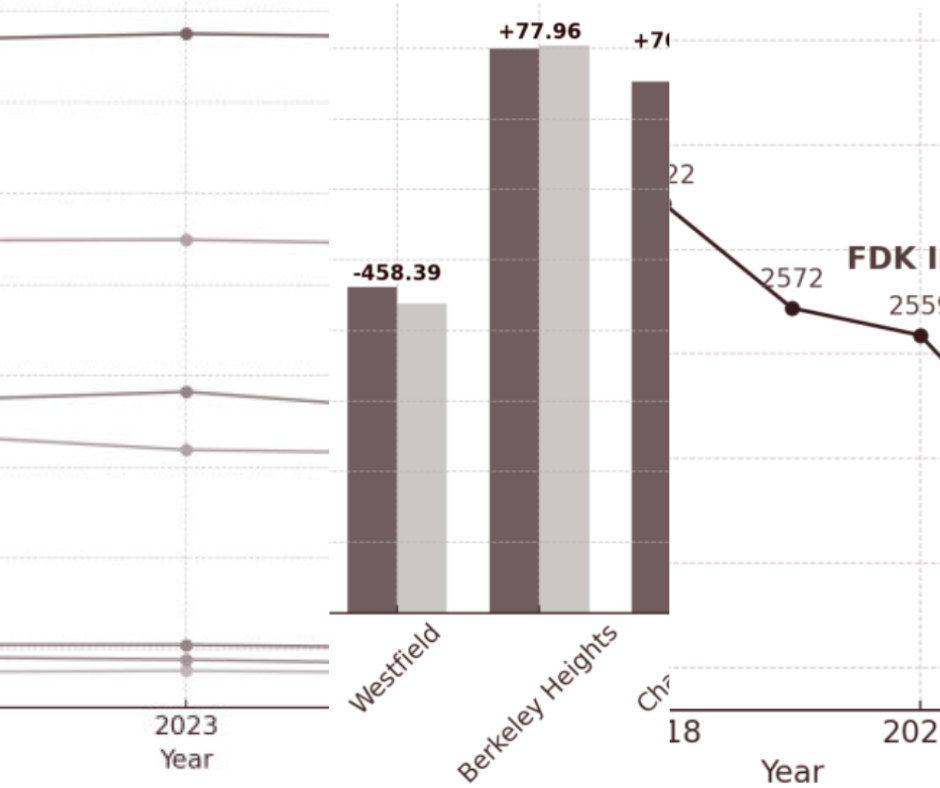

County appropriations went up about $11.2M from 2024, and non-tax revenues slipped by $2.5M, leaving the tax levy to rise by $13.7M.

So despite the flat rate touted by the county, the bill in the mailbox weighs a little more.

The biggest recurring costs are in the same spots we saw with the other three counties in the 21st: salaries, health benefits, and pensions. The recap of group insurance appropriations shows $71.1M budgeted for 2025, with employee contributions covering about $5.5M of that.

The budget also puts aside $2.8M for the Capital Improvement Fund. That’s just the piece inside the operating budget. The county has also pushed broader $35M capital plan covering roads, bridges, and culverts, but that larger figure comes from the county’s capital plan documents, not the appropriations schedule.

Tucked into the budget narrative is a reminder of a $3.2M county guarantee tied to solar program financing, flagged under “structural imbalances.”

To balance the budget, Morris put its hand into a $30.7M surplus.

| Category | 2024 | 2025 | Change ($) | Change (%) |

|---|---|---|---|---|

| Appropriations | $365,336,600.54 | $376,553,876.64 | $11,217,276.10 | +3.07% |

| Non-Tax Revenues | $85,010,242.41 | $82,521,232.65 | −$2,489,009.76 | −2.93% |

| County Purpose Tax (Levy) | $280,326,358.13 | $294,032,643.99 | $13,706,285.86 | +4.89% |

| Surplus Used | $30,211,156.00 | $30,711,156.00 | $500,000.00 | +1.65% |

How Morris Compares

Union broke a four-year freeze with a 1.75% levy hike.

Middlesex watched debt service spike nearly 13%, with the levy climbing even as the tax rate fell.

Somerset County kept its budget modest, but the levy rose about 6%, adding $79 to the average homeowner’s bill.

Morris County calls it a flat rate as it pushed the levy up almost 5%.

| County | 2024 Levy | 2025 Levy | Change ($) | Change (%) | Notes |

|---|---|---|---|---|---|

| Union | — | — | — | +1.75% | Broke a 4-year freeze |

| Middlesex | — | — | — | — | Debt service +12.8%; levy rose despite rate cut |

| Somerset | $226,400,000 | $239,700,000 | $13,300,000 | +5.9% | ~$79 more for avg. homeowner |

| Morris | $280,326,358 | $294,032,644 | $13,706,286 | +4.9% | Marketed as “flat rate” |

The messaging changes, but the outcome doesn’t..folks are paying more.

What’s Different?

Morris leans harder than its neighbors on the “flat rate” talking point, even though the levy increase tells another story. It also set aside more money for infrastructure than Somerset or Union, with its $35 million capital plan, but that means bigger debt service obligations later on. Its $30.7 million surplus gives it a larger cushion than Somerset, but one that may not last if revenues keep eroding.

Source Documents

Voluntary contributions are critical to independent, fact based reporting. If you appreciate our work please consider a financial contribution.

Also Read

Scutari, OPRA, and the Missing Answers in Union County’s Budgets

Somerset County’s 2025 Budget – Aid Dropped, Debt Popped

Middlesex 2025 Budget – Same Song, Different County

|