-Authored by the Short Hills Association and submitted by Jay Morreale

This is the first in a series of articles by the Short Hills Association on property taxes

and the reassessment process.

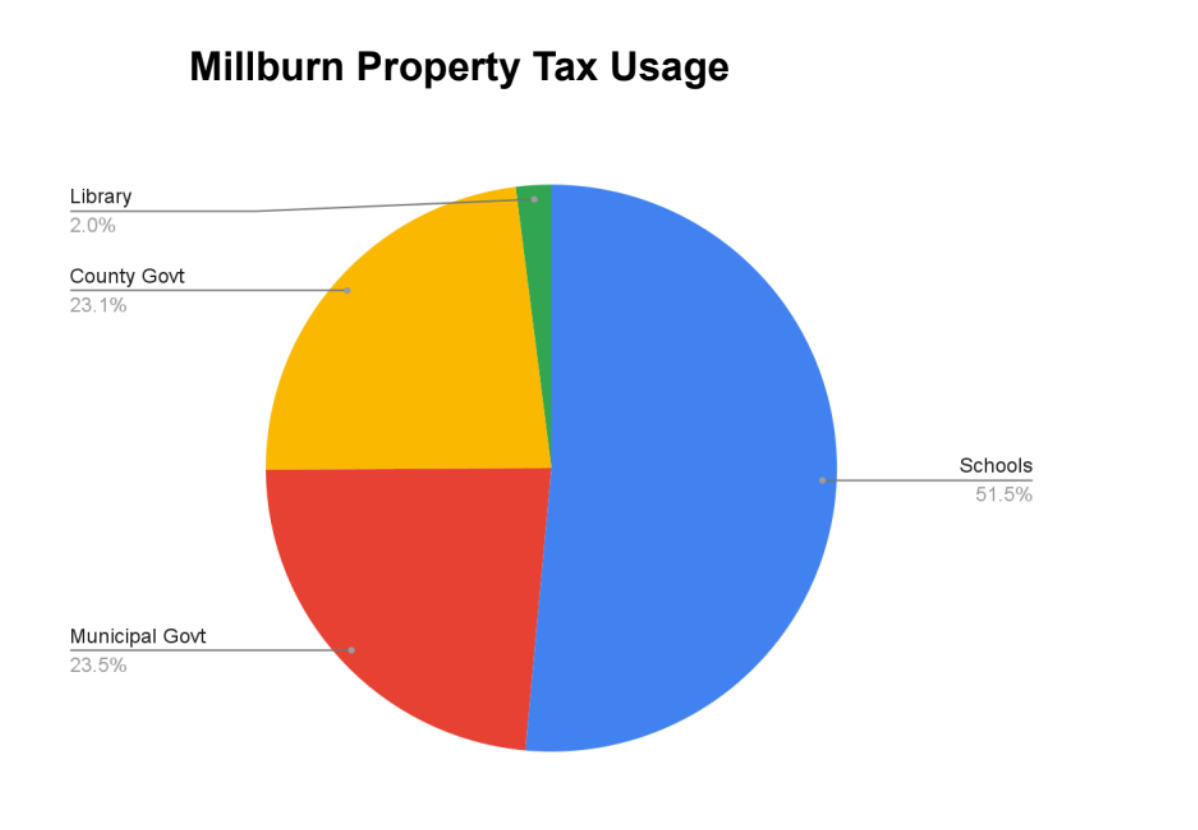

Property Tax in New Jersey is one of the oldest forms of taxation dating back to 1670 in

the earliest years of English rule. A tax of one half penny per acre funded the colonial

government back then. Today, property tax funds schools, municipal government and

county government and to a small degree the library.

Property tax is allocated to property owners based on the assessed value of the property. The methods for determining the assessed value of property are complex and varied. Residential property uses one method based on the market value of the land and the house on it while commercial property is assessed using one of several different methods as set by state law.

There are many misconceptions surrounding property tax and the assessment process. Through a series of articles we hope to dispel some of these and to demystify the process. Over the course of the year we will publish information on several topics related to property tax including:

● Uses of property tax – schools, municipal and county budgets

● Equalization – each municipality’s share of Essex County’s budget is allocated in proportion to the municipality’s share of total Essex County property market value. Equalization refers to the process of advancing each municipality’s assessed value to a current date to achieve current market values

● The Assessment process – how is it conducted and residential versus commercial property assessments

● New Development Tax Implication

● Other Topics – Annual Reassessment, Bond Referendums, Exempt Property, Abandoned Property, Assessment Challenges, Anchor and Stay NJ

According to data from the State of NJ, Millburn has the second highest per household property tax in the state at $25,407 (as of 2024). Only Tavistock NJ, population 9, is higher. While many believe this is because of the high residential property valuations, the main drivers are the costs to run the school system and the municipal and county governments. We will cover these in a future article.

The Essex County Board of Taxation determines when each municipality is required to perform its reassessment. The Board has decided Millburn must complete its process in time for property taxes in 2029. Individual property assessments will occur for every residential and commercial property as part of the process.

For more information:

A Short History of New Jersey Property Tax

New Jersey Property Tax Data

Millburn 2025 Budget Presentation

Short Hills Association

|